Financial Information

Expenditure and Acquisition Plans

APPROVED 2022 and 2023 Expenditure and Acquisition Plan

PROPOSED Amendment to 2022 and 2023 Expenditure and Acquisition Plan

PROPOSED 2024-2025 Expenditure and Acquisition Plan

PROPOSED 2nd Amendment to 2024-2025 Expenditure and Acquisition Plan

Year-End Financial Statements

2023 Conservation Area Fund

2023 Stewardship and Management Fund

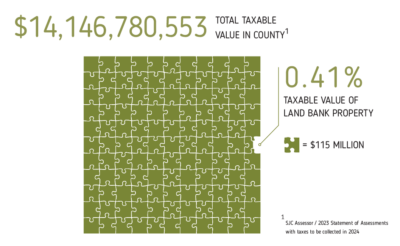

We are often asked if Land Bank acquisitions “take land off the tax rolls,” resulting in higher property taxes for other landowners. The answer is yes, but very little.

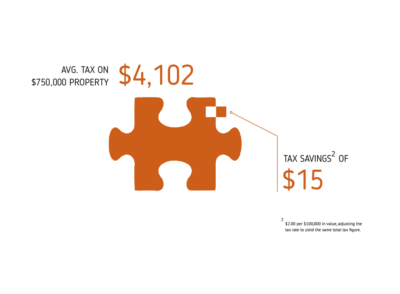

The taxable value of Land Bank Preserves is less than one half of one percent (0.41%) or $60 million of the County’s $14.15 billion in total taxable value. If all Land Bank property were taxed, and the tax rate lowered as a result, the savings to property owners would be roughly $2 per $100,000 in value, reducing the annual tax on a $750,000 property by only $15.00 What a bargain! In return, you get 31 Preserves open to the public, 400 acres leased to local farmers, hundreds of acres of forests restored, and iconic landscapes protected from mountaintops to coastlines.

These are the numbers for today. But we think it’s important to recognize that conservation has a tangible value to the community It comes in the form of ecosystem services – clean air and water; moderation of climate; timeless refuge. These, nature gives us for free…if we conserve it.

[1] Approximately 1,000 properties; 300 adjacent parcels and, roughly estimated, 700 nearby parcels.